ARM vs. Fixed Rate Analyzer

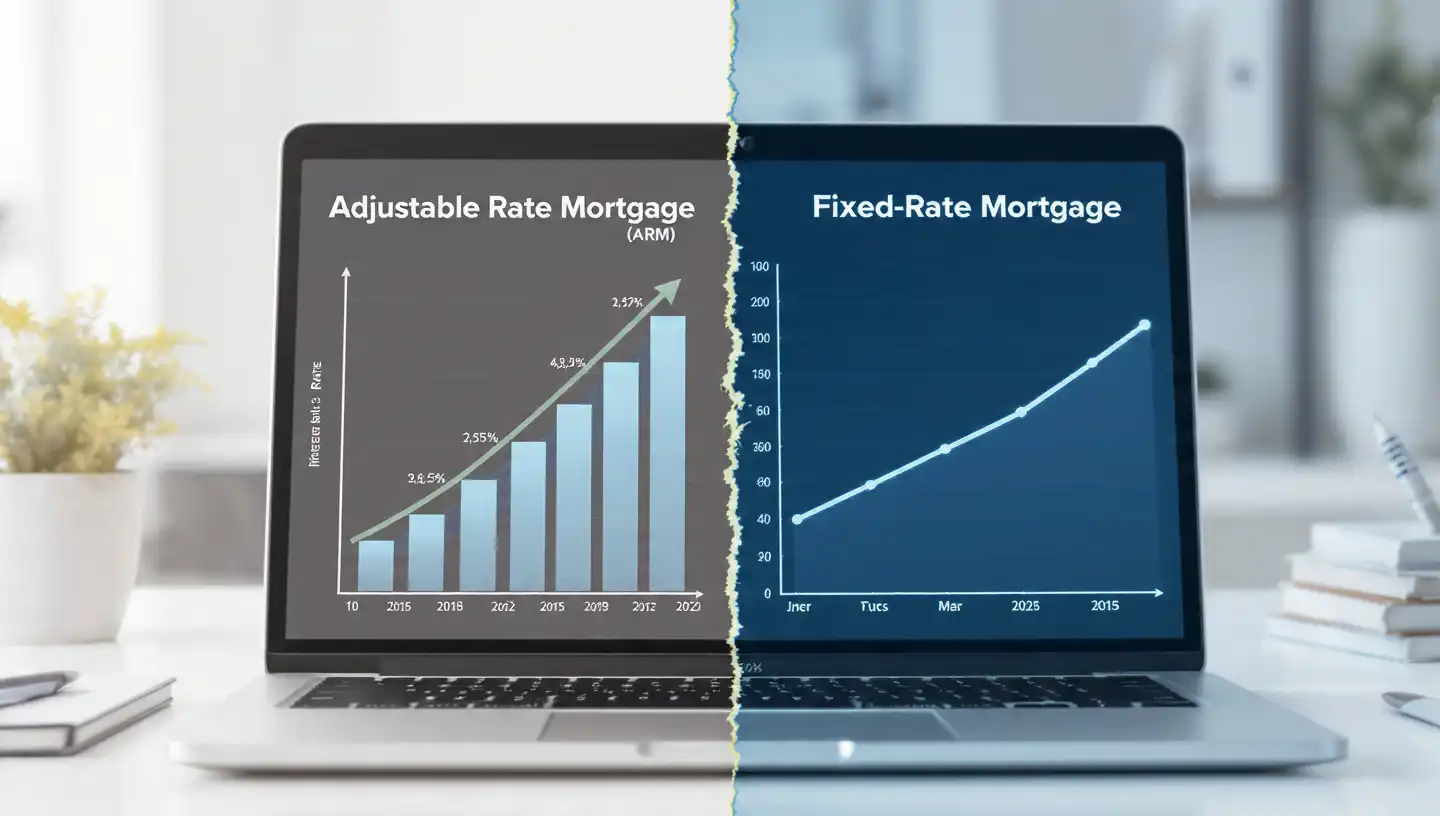

Is the lower initial rate of an ARM worth the risk of higher future payments?

How This Tool Works

This calculator analyzes the trade-off between the stability of a Fixed Rate Mortgage and the potential initial savings of an Adjustable Rate Mortgage (ARM).

- Fixed Rate Logic: Your payment never changes. It offers maximum protection against rising inflation and interest rates.

- ARM Logic: You get a lower "teaser" rate for a set period (e.g., 5 years). After that, the rate adjusts annually based on a market index.

- Risk Simulation: We calculate the "Worst Case Scenario" by assuming the rate jumps to your lifetime cap immediately after the fixed period ends.

How to Use (Steps)

- Loan Amount: Enter the total amount you intend to borrow.

- Fixed Scenario: Enter the quoted rate for a standard 30-year fixed loan.

- ARM Scenario: Enter the initial rate, the length of the fixed period (e.g., 5 for a 5/1 ARM), and the lifetime cap.

- Analyze: Compare the monthly savings during the fixed period vs. the potential "payment shock" afterward.

Example Calculation

Scenario: $350,000 Loan. Fixed (6.5%) vs. 5/1 ARM (5.0% with 10%

Cap).

• Fixed Payment: $2,212/mo (Steady for 30 years).

• ARM Initial: $1,879/mo (Savings of $333/mo for 5 years).

• ARM Worst Case: After year 5, payment could jump to ~$2,950/mo.

• Verdict: If you sell in 5 years, the ARM saves you ~$20,000. If you stay

for 30 years and rates spike, the ARM costs you ~$100,000 more in interest.

Why This Tool Is Accurate

Lenders often highlight only the lower initial ARM payment. This tool forces you to look at the Lifetime Cap, which is the only way to mathematically understand your "Maximum Financial Exposure" if the economy changes.

Limitations & Disclaimer

This tool assumes a one-time jump to the maximum rate for the "Worst Case" simulation. In reality, ARMs usually have periodic caps (e.g., 2% per year). Always review your Specific Loan Estimate for exact adjustment rules.

Frequently Asked Questions

It depends on your "Holding Period." If you are 100% sure you will sell or refinance the home within the fixed period (e.g., within 5 years), an ARM is almost always better because it reduces your interest expense. If this is your "forever home," a Fixed Rate is safer.

A cap is a legal limit on how much your interest rate can rise. There are usually periodic caps (how much it can rise at once) and lifetime caps (the absolute maximum rate you will ever pay). This calculator focuses on the lifetime cap risk.

In a 5/1 ARM, the rate is fixed for 5 years and then adjusts every 1 year thereafter. The adjustment is based on a market index (like SOFR) plus a fixed "margin" set by your lender.